There is an information gap on the significance of non-fuel minerals for the defence industry. As the reliability of future supplies of strategic metals and alloys is of increasing concern to many nations, there is a widespread demand for pooling such information, as found in cooperative efforts like the International Strategic Minerals Inventory (ISMI) that was started – in 1981 – by the governments of Canada, (West) Germany, and the US, and which was later joined by Australia, South Africa, and the UK. NAVAL FORCES, in a briefing earlier this year, noted that military strategists and policymakers often say that they are not aware of the importance of long-term, secure supplies of strategic commodities used in various components of defence weapon systems.

Another group of metals, rare earths or Rare Earth Elements (REE), could be in imminent danger that is due to cuts in Chinese exports. Members of Congress have expressed concern over US acquisition of REE in 2010, when a series of events and press reports highlighted what some referred to as the ‘Rare Earth Crisis’. One event that occurred in July 2010 has been the announcement by China’s Ministry of Commerce that China would cut its exports of REE by about 72%. In September 2010, China temporarily cut REE exports to Japan, apparently over the the dispute on the Senkaku/Diaoyu islands in the East China Sea that has further accelerated during 2013 and 2014. Policymakers in Washington were concerned that China had cut its REE exports and appeared to be restricting the world’s access to these commodities, with a nearly total US dependence on China for REE, including oxides, phosphors, metals, alloys, and magnets.

The same is completely true with regard to titanium used for the JSF.

According to the 2013 Annual Industrial Capabilities Report to Congress issued in October 2013, “these materials [REE] gained considerable attention in 2011 as prices increased drastically and concerns rose over their availability especially due to one nation, China, being the source of over 95% of the global supply.” In 2013, China supplied 92% of the global REE and produced over 70% of the world’s REE components and products. As said by the The Hague Centre for Strategic Studies (HCSS) and TNO, also Europe is currently completely depended on imported REE raw materials, mainly from China. In total, Canada, France, Germany, Japan, and the United States have invested €732 million in China’s REE industry in recent years. In clear contrast, the investments in the exploration and development of REE resources mainly delineated in the Scandinavian Shield – about 1.7 million metric tons (Mt) of rare earth oxides (REO) contained in four major occurrences – only amounted to roughly €15.5 million.

“Both the German government and EU Commission classify REE as strategically important metals, whose supply is at risk. Also within the German industry, the sustainable supply of rare earths is considered critical”, a representative of Seltenerden Storkwitz AG told NAVAL FORCES (NAFO), sister magazines of MT. The company is currently investigating continental Europe’s only REE resource, the Storkwitz deposit in Saxony. The resource that is located in the so-called Delitzsch Carbonatite Complex, contains 38,000mt of REO plus 7,000mt of niobium. The latter also is a critical strategic metal used in the defence industry. The resource base could be expanded to over 80,000mt of REO, according to Seltenerden Storkwitz AG.

A report, entitled “EURARE: Development of a Sustainable Exploitation Scheme for Europe’s REE Ore Deposits,” came to the conclusion that at least five REE are considered critical for clean energy production: neodymium, europium, terbium, dysprosium and yttrium. Therefore, the authors of the report call for a clearer definition and assessment of the exploitable REE mineral resources and REE demand in Europe; development of sustainable and efficient REE ore processing technology (that could result in the production of high-grade REE concentrates and minimisation of tailings); and development of sustainable REE extraction and refining technologies. To realise this, European policymakers see the Kvanefjeld project in Greenland to potentially supply more than 20% of the global REE demand, in addition to the Norra Kärr project in Sweden owned by Tasman Metals Inc. The latter could potentially supply 14% of the projected 2014 world demand in dysprosium oxide, 7% in terbium oxide, and 2.2% of neodymium oxide.

Although isolated carbonatite complexes such as Mount Weld in Australia do occur, most are in clusters or linear belts like those associated with rift zones in eastern Africa and the Araxá-Catalão belt in Brazil. The latter hosts one of the world’s largest REE and niobium resources, of which the Barreiro Complex at Araxá in the State of Minas Gerais comprises >450Mt of ore averaging 4.4% REO and 2.5% Nb2O5. An additional 0.8Mt of supergene-enriched laterite ore in the area averages 13.5% REO, mainly in the phosphate minerals gorceixite and goyazite.

African countries host 17 economically significant deposits of REE-enriched laterites, some of them located in disputed areas. The most thoroughly investigated deposit is probably the monazite-rich laterite overlying the carbonatite at Mrima Hill in Kenya. It contains an approximately 6Mt of material with about 5% REO. NAVAL FORCES was told that several of the African carbonatites located in Angola (Bonga and Capuia), Malawi (Kangankunde Hill), Mali (Adiounedj and Anezrouf), Mauritania (Bou Naga), Namibia (Eureka, containing a proven reserve of 0.03Mt at 6.3% REE to a depth of 20m; Ondurukurme Complex with some 8Mt at 3% REO and 0.3% Nb2O5), Uganda (Lolekek), Zambia (Nkombwa Hill), and the Democratic Republic of the Kongo (Nirumba) remain to be largely unexploited. Among them, Kangankunde Hill in Malawi, is underlain by carbonatite dikes in which the main REE phase is monazite that is almost thorium-free. An official of the Bundesanstalt für Geowissenschaften & Rohstoffe (BGR) in Hannover, Germany, told NAFO that carbonatite dikes at Wigu Hill, Tanzania, contain up to 20% REO as monazite and REE fluorocarbonate minerals of possible hydrothermal origin. Also, the Palabora carbonatite in South Africa, which occurs in a large Early Proterozoic potassic alkaline complex, has significant copper and apatite production, and has been evaluated as a source of REE. Potential by-product output from apatite concentrates that contain 0.4% to 0.9% REO has been estimated at 4,250mt annually.

The success of exploratory work of Southeast Asian REE resources is believed to be highly dependent upon investments by Chinese and Japanese industrial groups. REE deposits in Vietnam’s Lai Châu Province are reported to deliver lanthanide concentrates to Japan, based on an agreement of Japan’s Dong Pao Rare Earth Development Company with the Vietnamese firm Lai Châu-VIMICO Rare Earth Joint Stock Company. Western sources quoted an “identified plus inferred resource basis” of 19.2Mt of ore for the mining project, with grades ranging from 1.4% to 5% REO.

Chinese influence has also been reported from Bangladesh, where most of the commercially significant deposits are in sands of marine origin along or near present coastlines, and consist of titanium mineral placers with by-product zircon, monazite, and xenotime, of which the latter is also a source for scandium. In Malaysia, Hong Kong-based Commerce Venture Manufacturing (CVM) Minerals signed an MoU with the Perak State Government for creating a joint venture to produce lanthanide concentrates from the Bukit Merah REE deposit.

According to the US Geological Survey (USGS), laterite deposits, most of them located in developing countries in the Pacific Rim region and South America, provide roughly half of the world’s production of nickel and cobalt plus chromium. So-called ‘nickel laterites’ typically occur in regions where prolonged weathering of ultramafic rocks (containing ferro-magnesian minerals) has occurred, favoured by warm conditions with abundant rainfall. According to the USGS report entitled “Ni-Co Laterite Deposits of the World – Database and Grade and Tonnage Models”, such “residual materials contain about 70% of world’s nickel resources, have been mined for more than 100 years, and account for about 50% of world’s nickel production in 2012”.

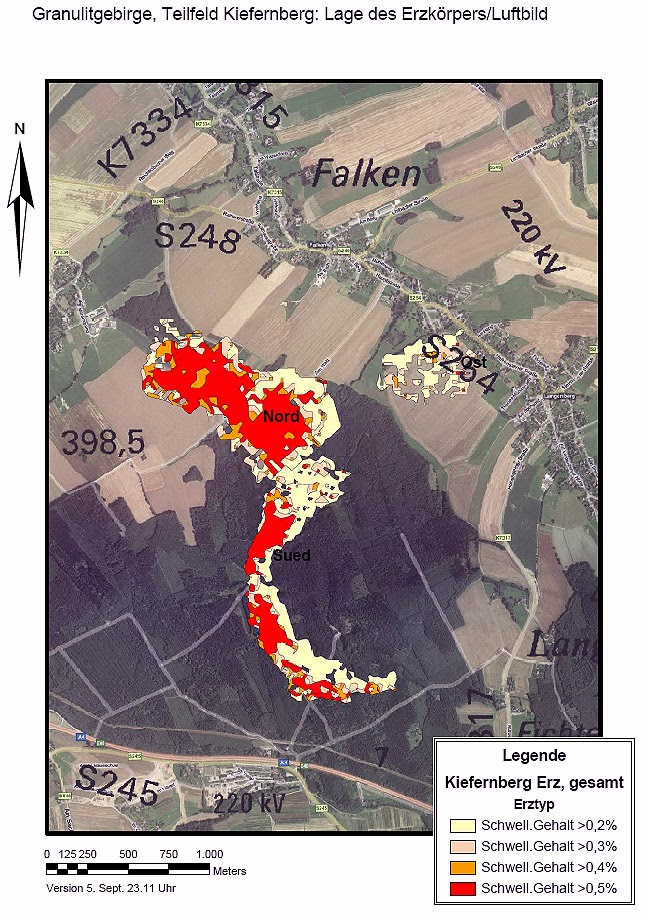

Owing to the potential for comparatively low capital costs and lower economic cut-off ore grades, heap leaching has been proposed as an alternative processing route for the processing of nickel laterites by a number of recent projects: European Nickel’s Çaldağ project in Turkey; Acoje project in the Philippines; Vale’s Piauí project in Brazil; Metallica Minerals’ Nornico project in Australia; and Proto Resources’ Kiefernberg (Granulite Mountains) project in Germany. The latter project, located approximately 50km west of Dresden in Saxony, comprises a licence area of 670.4km2, and contains a former nickel open pit mine as well as several already identified unexploited mineralised zones. The results derived from 1,270 drilling holes have “identified a non-compliant nickel-cobalt-chrome resource“contained in a laterite cap measuring up to 7m in thickness, according to Proto Resources. The company’s Managing Director, Andrew Mortimer, pointed to the strategic significance of the acquisition; “Kiefernberg is the perfect fit for Proto, and will allow us to leverage the nickel processing technology we have been piloting for Barnes Hill [in Australia] into an environment marked by excellent infrastructure. Our ability to cheaply and rapidly replicate the extensive development work undertaken for Barnes Hill will be key to our plans to build nickel production tonnage over the next few years,” he said.

Despite a slightly decreasing demand in REE since about 2011 (due to the substitution of other materials for rare earth materials), two new projects in particular should have a significant impact on the markets from 2014/2015. REO production that has commenced in Malaysia (Bukit Merah mine) and in the US will add approximately 40,000 metric tons of oxide production capacity to the global supply chain by 2014, close to one-third of the forecasted demand. Furthermore, it was anticipated that the facility in the US (Molycorp’s Mountain Pass operations in California, also known as Project Phoenix) will have the capability to increase its capacity by an additional 20,000 metric tons in 2013/2014, according to the DoD.

The twist to the story comes with current crises in Ukraine, Mali, and other regions of the world.

Ukraine, for example, is highly dependent upon exports to the west, notably ferromanganese, ferrosilicon, silicomanganese, magnesium metal, ferronickel, ilmenite concentrate, titanium sponge, zirconium concentrate, and germanium. It is feared that Russian President Vladimir Putin will not cease operations by Russian troops that, meanwhile, have illegally crossed the border into eastern and southeastern Ukraine, also threatening Ukraine’s huge potential of natural resources and metallurgic sector.

(For additional information on Ukrainian resources see NAVAL FORCES III/2014, page 12/13.)

.jpg) |

| The F-35 JSF in production for Australia, Italy, the Netherlands, Norway, the UK, and the US is dependent upon titanium supplies from China. (Photo: US Marine Corps) |

Deep Trouble

Recent reports that China anticipates series production of combat aircraft engines, which can handle higher internal temperatures, were of great concern mainly in the West. Asian sources were saying that with the use of rhenium, a strategic metal that is very generally short of supply, Chinese manufacturers will produce single-crystal blades for WS-10 TAINHANG-powered J-10 and J-11 fighter aircraft. Some 5 metric tons of metal are needed annually from 2016, a figure that is equivalent to over 10% of the world’s annual production. This figure is equivalent to the quantity of rhenium used by Pratt & Whitney for the manufacturing of parts of its F135 engine for the Lockheed Martin F-35 Joint Strike Fighter (JSF). Rhenium is generally recovered, together with molybdenum, from so-called ‘porphyry copper’ deposits, but it is also enriched in sedimentary copper resources, called ‘Kupferschiefer’ (copper shale) in central and eastern Germany, where the metal, together with other critical metals like molybdenum, tellurium, silver, gold, and platinum group metals (PGM), could be a by-product of a large-scale underground copper mining operation by 2018 or 2019. In southwestern Poland, a ‘world class’ deposit of this type is already in production.Another group of metals, rare earths or Rare Earth Elements (REE), could be in imminent danger that is due to cuts in Chinese exports. Members of Congress have expressed concern over US acquisition of REE in 2010, when a series of events and press reports highlighted what some referred to as the ‘Rare Earth Crisis’. One event that occurred in July 2010 has been the announcement by China’s Ministry of Commerce that China would cut its exports of REE by about 72%. In September 2010, China temporarily cut REE exports to Japan, apparently over the the dispute on the Senkaku/Diaoyu islands in the East China Sea that has further accelerated during 2013 and 2014. Policymakers in Washington were concerned that China had cut its REE exports and appeared to be restricting the world’s access to these commodities, with a nearly total US dependence on China for REE, including oxides, phosphors, metals, alloys, and magnets.

The same is completely true with regard to titanium used for the JSF.

Western Countries Spend Less

The 15 elements belonging to the group of REE plus two other elements, yttrium and scandium, are referred to as ‘rare’ because, while they are relatively abundant in quantity, they appear in low concentrations in the earth’s crust, and economic extraction and processing is both difficult and costly. They are a unique group of chemical elements that exhibit a range of special electronic, magnetic, optical, and catalytic properties. So, they have hundreds of applications for the manufacturing of high-tech military hardware: fin actuators in missile guidance and control systems; disk drive motors installed in aircraft, tanks, missile systems and C2 centres; lasers for mine detectors, interrogators, underwater mines and countermeasures; satellite communications, radars and sonars; optical devices; ceramics (e.g. jet engine coatings); and propulsion systems (e.g. rechargeable batteries, fuel cells).According to the 2013 Annual Industrial Capabilities Report to Congress issued in October 2013, “these materials [REE] gained considerable attention in 2011 as prices increased drastically and concerns rose over their availability especially due to one nation, China, being the source of over 95% of the global supply.” In 2013, China supplied 92% of the global REE and produced over 70% of the world’s REE components and products. As said by the The Hague Centre for Strategic Studies (HCSS) and TNO, also Europe is currently completely depended on imported REE raw materials, mainly from China. In total, Canada, France, Germany, Japan, and the United States have invested €732 million in China’s REE industry in recent years. In clear contrast, the investments in the exploration and development of REE resources mainly delineated in the Scandinavian Shield – about 1.7 million metric tons (Mt) of rare earth oxides (REO) contained in four major occurrences – only amounted to roughly €15.5 million.

“Both the German government and EU Commission classify REE as strategically important metals, whose supply is at risk. Also within the German industry, the sustainable supply of rare earths is considered critical”, a representative of Seltenerden Storkwitz AG told NAVAL FORCES (NAFO), sister magazines of MT. The company is currently investigating continental Europe’s only REE resource, the Storkwitz deposit in Saxony. The resource that is located in the so-called Delitzsch Carbonatite Complex, contains 38,000mt of REO plus 7,000mt of niobium. The latter also is a critical strategic metal used in the defence industry. The resource base could be expanded to over 80,000mt of REO, according to Seltenerden Storkwitz AG.

A report, entitled “EURARE: Development of a Sustainable Exploitation Scheme for Europe’s REE Ore Deposits,” came to the conclusion that at least five REE are considered critical for clean energy production: neodymium, europium, terbium, dysprosium and yttrium. Therefore, the authors of the report call for a clearer definition and assessment of the exploitable REE mineral resources and REE demand in Europe; development of sustainable and efficient REE ore processing technology (that could result in the production of high-grade REE concentrates and minimisation of tailings); and development of sustainable REE extraction and refining technologies. To realise this, European policymakers see the Kvanefjeld project in Greenland to potentially supply more than 20% of the global REE demand, in addition to the Norra Kärr project in Sweden owned by Tasman Metals Inc. The latter could potentially supply 14% of the projected 2014 world demand in dysprosium oxide, 7% in terbium oxide, and 2.2% of neodymium oxide.

Rare Earths at Risk in Africa, Asia

So-called ‘carbonatite-hosted’ REE resources are widespread (some 527 complexes of this genetic type are known worldwide), but the bulk of them are closely associated with continental environments and generally related to large-scale, intra-plate fractures, grabens or rifts, rather than oceanic environments. For example, Russia’s REE resources are mainly confined to the peralkaline Paleozoic Lovozero Massif on the Kola Peninsula that is enriched in yttrium, heavy REE (HREE), and zirconium. According to Russian geologists, during the 1980s, when the yttrium demand exceeded its supplies, exploration for yttrium-rich REE deposits led to the discovery of zirconium and HREE-dominated resources that are associated with peralkaline syenitic (coarse-grained intrusive igneous) and granitic rocks. Some have associated beryllium, niobium, and tantalum, critical strategic metals that do have numerous defence-related applications.Although isolated carbonatite complexes such as Mount Weld in Australia do occur, most are in clusters or linear belts like those associated with rift zones in eastern Africa and the Araxá-Catalão belt in Brazil. The latter hosts one of the world’s largest REE and niobium resources, of which the Barreiro Complex at Araxá in the State of Minas Gerais comprises >450Mt of ore averaging 4.4% REO and 2.5% Nb2O5. An additional 0.8Mt of supergene-enriched laterite ore in the area averages 13.5% REO, mainly in the phosphate minerals gorceixite and goyazite.

African countries host 17 economically significant deposits of REE-enriched laterites, some of them located in disputed areas. The most thoroughly investigated deposit is probably the monazite-rich laterite overlying the carbonatite at Mrima Hill in Kenya. It contains an approximately 6Mt of material with about 5% REO. NAVAL FORCES was told that several of the African carbonatites located in Angola (Bonga and Capuia), Malawi (Kangankunde Hill), Mali (Adiounedj and Anezrouf), Mauritania (Bou Naga), Namibia (Eureka, containing a proven reserve of 0.03Mt at 6.3% REE to a depth of 20m; Ondurukurme Complex with some 8Mt at 3% REO and 0.3% Nb2O5), Uganda (Lolekek), Zambia (Nkombwa Hill), and the Democratic Republic of the Kongo (Nirumba) remain to be largely unexploited. Among them, Kangankunde Hill in Malawi, is underlain by carbonatite dikes in which the main REE phase is monazite that is almost thorium-free. An official of the Bundesanstalt für Geowissenschaften & Rohstoffe (BGR) in Hannover, Germany, told NAFO that carbonatite dikes at Wigu Hill, Tanzania, contain up to 20% REO as monazite and REE fluorocarbonate minerals of possible hydrothermal origin. Also, the Palabora carbonatite in South Africa, which occurs in a large Early Proterozoic potassic alkaline complex, has significant copper and apatite production, and has been evaluated as a source of REE. Potential by-product output from apatite concentrates that contain 0.4% to 0.9% REO has been estimated at 4,250mt annually.

The success of exploratory work of Southeast Asian REE resources is believed to be highly dependent upon investments by Chinese and Japanese industrial groups. REE deposits in Vietnam’s Lai Châu Province are reported to deliver lanthanide concentrates to Japan, based on an agreement of Japan’s Dong Pao Rare Earth Development Company with the Vietnamese firm Lai Châu-VIMICO Rare Earth Joint Stock Company. Western sources quoted an “identified plus inferred resource basis” of 19.2Mt of ore for the mining project, with grades ranging from 1.4% to 5% REO.

Chinese influence has also been reported from Bangladesh, where most of the commercially significant deposits are in sands of marine origin along or near present coastlines, and consist of titanium mineral placers with by-product zircon, monazite, and xenotime, of which the latter is also a source for scandium. In Malaysia, Hong Kong-based Commerce Venture Manufacturing (CVM) Minerals signed an MoU with the Perak State Government for creating a joint venture to produce lanthanide concentrates from the Bukit Merah REE deposit.

Cheap Alternatives

Besides REE and by-product niobium, the defence industry is highly dependent upon other critical metals: nickel; cobalt; chromium; tungsten (decreasing mine production in Austria; continuing mining operations in Brazil, South Korea, Spain; new projects in Germany, Portugal, UK); lithium; tin (new mining ventures in Germany, Morocco, Spain); tantalum (Ghurayyah tantalum-niobium-REE project in Saudi Arabia awaiting approval); and gallium, germanium and indium. Both germanium and indium are contained in flat screen displays and laptops.According to the US Geological Survey (USGS), laterite deposits, most of them located in developing countries in the Pacific Rim region and South America, provide roughly half of the world’s production of nickel and cobalt plus chromium. So-called ‘nickel laterites’ typically occur in regions where prolonged weathering of ultramafic rocks (containing ferro-magnesian minerals) has occurred, favoured by warm conditions with abundant rainfall. According to the USGS report entitled “Ni-Co Laterite Deposits of the World – Database and Grade and Tonnage Models”, such “residual materials contain about 70% of world’s nickel resources, have been mined for more than 100 years, and account for about 50% of world’s nickel production in 2012”.

Owing to the potential for comparatively low capital costs and lower economic cut-off ore grades, heap leaching has been proposed as an alternative processing route for the processing of nickel laterites by a number of recent projects: European Nickel’s Çaldağ project in Turkey; Acoje project in the Philippines; Vale’s Piauí project in Brazil; Metallica Minerals’ Nornico project in Australia; and Proto Resources’ Kiefernberg (Granulite Mountains) project in Germany. The latter project, located approximately 50km west of Dresden in Saxony, comprises a licence area of 670.4km2, and contains a former nickel open pit mine as well as several already identified unexploited mineralised zones. The results derived from 1,270 drilling holes have “identified a non-compliant nickel-cobalt-chrome resource“contained in a laterite cap measuring up to 7m in thickness, according to Proto Resources. The company’s Managing Director, Andrew Mortimer, pointed to the strategic significance of the acquisition; “Kiefernberg is the perfect fit for Proto, and will allow us to leverage the nickel processing technology we have been piloting for Barnes Hill [in Australia] into an environment marked by excellent infrastructure. Our ability to cheaply and rapidly replicate the extensive development work undertaken for Barnes Hill will be key to our plans to build nickel production tonnage over the next few years,” he said.

Conclusion

In a seven-page report, which was issued in March 2012, Congress encouraged the DoD to develop a collaborative, long-term strategy designed to identify any material weaknesses and vulnerabilities associated with rare earths and other strategic and critical materials required to meet the defence, industrial, and essential civilian needs of the United States. The list presented in the report contains ferroniobium, dysprosium metal, yttrium oxide, cadmium zinc tellurium substrate materials, and lithium ion precursors. Additionally, the Strategic and Critical Materials Report on Stockpile Requirements issued by the Office of the Under Secretary of Defense for Acquisition, Technology and Logistics in January 2013 lists four REE shortfalls that were identified; they are: erbium, terbium, thulium and scandium.Despite a slightly decreasing demand in REE since about 2011 (due to the substitution of other materials for rare earth materials), two new projects in particular should have a significant impact on the markets from 2014/2015. REO production that has commenced in Malaysia (Bukit Merah mine) and in the US will add approximately 40,000 metric tons of oxide production capacity to the global supply chain by 2014, close to one-third of the forecasted demand. Furthermore, it was anticipated that the facility in the US (Molycorp’s Mountain Pass operations in California, also known as Project Phoenix) will have the capability to increase its capacity by an additional 20,000 metric tons in 2013/2014, according to the DoD.

The twist to the story comes with current crises in Ukraine, Mali, and other regions of the world.

Ukraine, for example, is highly dependent upon exports to the west, notably ferromanganese, ferrosilicon, silicomanganese, magnesium metal, ferronickel, ilmenite concentrate, titanium sponge, zirconium concentrate, and germanium. It is feared that Russian President Vladimir Putin will not cease operations by Russian troops that, meanwhile, have illegally crossed the border into eastern and southeastern Ukraine, also threatening Ukraine’s huge potential of natural resources and metallurgic sector.

(For additional information on Ukrainian resources see NAVAL FORCES III/2014, page 12/13.)

Stefan Nitschke

.jpg)

.jpg)

.jpg)

.jpg)